USDA reports find more corn before the government shutdown

Howdy market watchers!

October is here! My favorite (birthday) month of the year! Combined with hopes of cooler temperatures and fall flavors, it is the precursor to the holiday season. It also means the fourth quarter has arrived! Just as the writing of “2025” becomes routine, it is soon to change again.

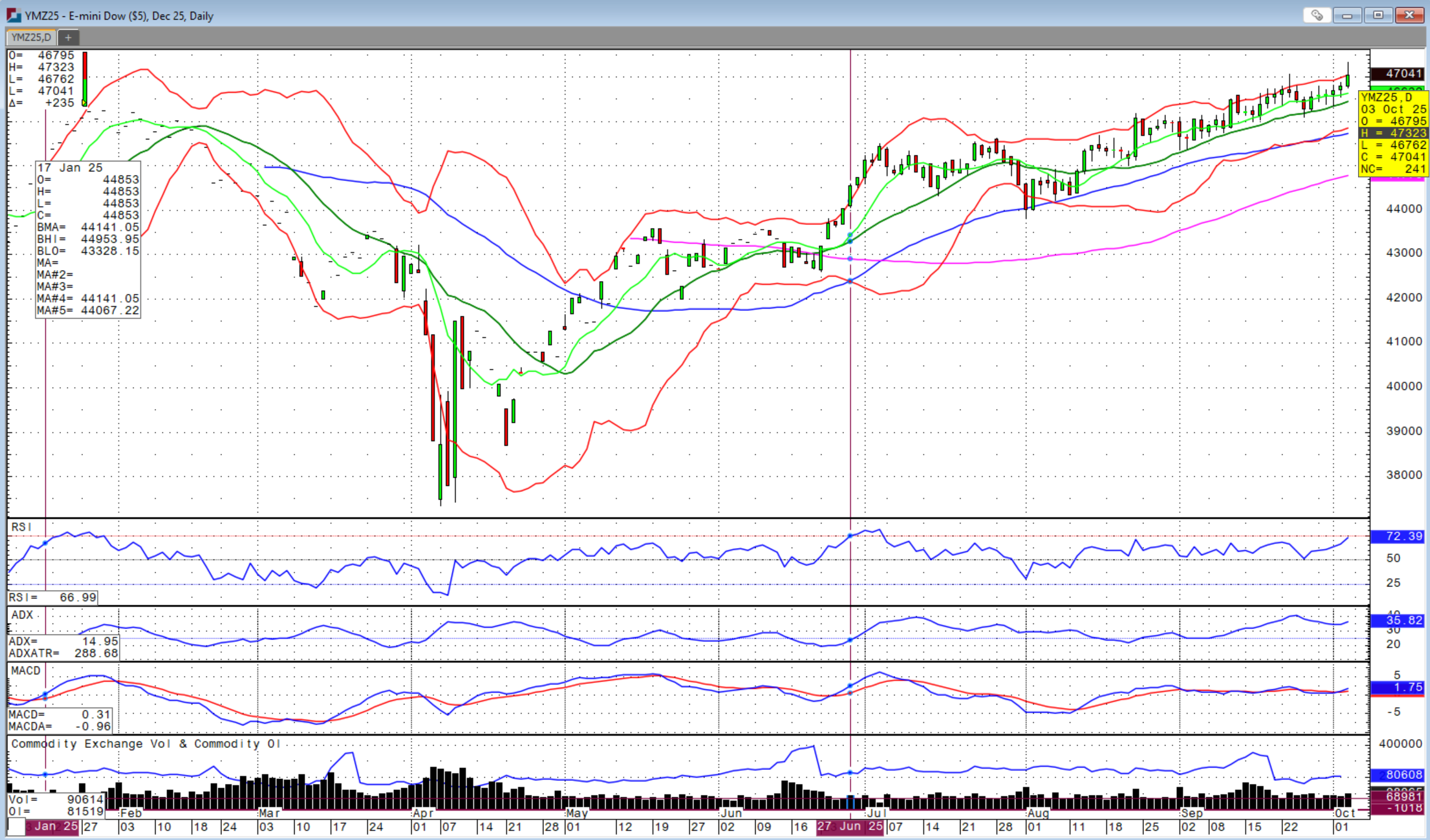

Speaking of change, there is so much of it happening in the world and so quickly. New alliances are being strengthened while historic ties are being stressed and rethought. Nationalistic politics are spreading around the world from the globalization ideology that has dominated much of the past decades. Supply chains are continually disrupted with contingency plans becoming activated in greater frequency. Artificial Intelligence (AI) is booming with associated stocks soaring and analysts are beginning to ask the questions if we’re in ‘another’ tech bubble or on the verge of the next Industrial Revolution.

Regardless of where we are in the ‘cycle’, there is little doubt that the world has permanently changed with the widespread application of AI soon to be in every part of our lives. The workforce will need to adapt as some job titles will forever be taken over by AI capabilities. While it was thought such change would be a ‘future thing’, it is already becoming a ‘right now thing’. I believe we will look back on 2025 as a transition year with job losses to AI becoming a real reason, especially as tight financial conditions cause companies to rethink hiring strategies and overhead.

The expansive facilities being built to support the explosion of AI is nothing short of remarkable. The associated power grid requirements are even more daunting, and it still doesn’t make sense how we’re going to generate the multiples of additional power needs demanded by AI when we already have shortages across the country. Prices will surely ration demand, but AI will be able to pay more than consumers and many businesses, which brings the question of how the ‘right to power’ will evolve in the AI boom.

And yet, here we sit with the government of the free world shutdown due to politicians seemingly being unable to compromise, regardless of whose fault one thinks it is. This week’s USDA grain stocks reports released on Tuesday were the last action of the agency before the furloughs. At this point, next Thursday’s scheduled USDA WASDE and Crop Production reports will not be released. Depending on when the government reopens, we will see if that report is skipped altogether until November or if it will just be delayed.

US jobs data and other economic reports are also nonexistent during a shutdown with the Federal Reserve’s next FOMC interest rate meeting on October 28th-29th. This next interest rate decision could be made virtually in the dark of where the US economy and labor market stands if the shutdown prolongs.

Tensions in the Black Sea are shifting and amplifying with the Trump Administration now firmly back to backing the Ukraine. VP Vance even mentioned this week of the potential for Tomahawk missiles to be deployed to the Ukraine. Russia continues to bombard the Ukraine as do they in giving it back.

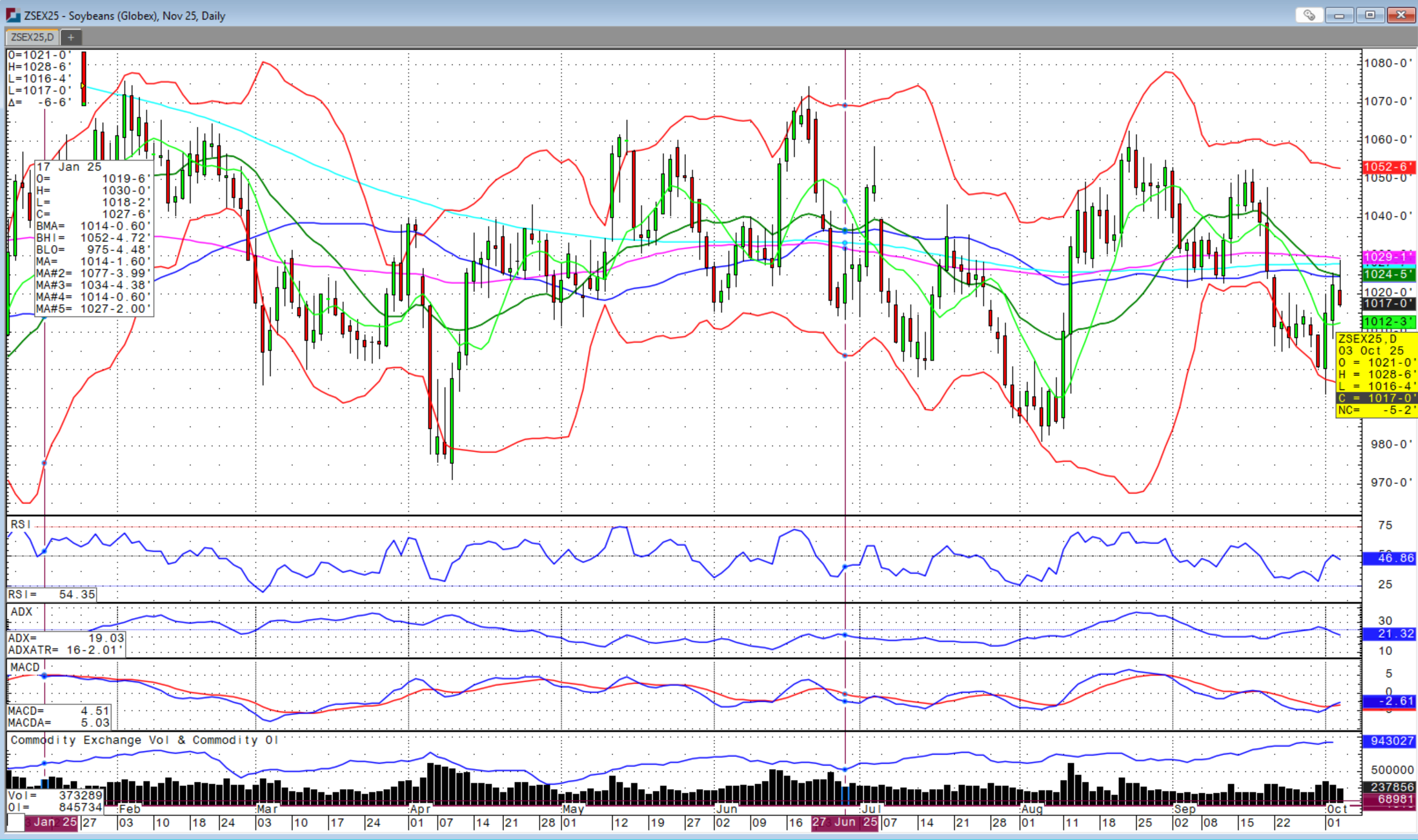

President Trump has apparently received the message that farmers are extremely frustrated with the impact on grain markets, particularly soybeans, from the chess game with China that has resulted in zero orders for new crop, US soybeans right at harvest time. While soybean futures are still decent, it is the basis bids in key states that rely on exports to China that is depressing the outlook.

In multiple tweets and comments, President Trump and Treasury Secretary Bessent this week strongly suggested that US farmers that backed them in the election would be backed, especially soybean producers. We saw this in President Trump’s first term as well and this time, it may be collected tariff revenues that are used to pay US farmers. It is unknown what and how large this program will be, but it is said that an announcement will be made on Tuesday and we will likely see $10-15 billion in support. This week, farmers received additional support from ECAP with funds received by farmers this week.

President Trump is also scheduled to meet with Chinese President Xi at the end of October at the APEC Summit in South Korea. There are hopes that some agreement on US ag purchases will be negotiated as we saw in Trump 45, but that is awhile to wait before the window begins to close for US exports before the Brazil harvest starts as early as January in some areas not to mention their domestic reserves and the recent Argentine purchases. China is on Golden Week all week.

US soybean harvest is now said to be 19 percent complete, as expected. US corn harvest is at 18 percent complete versus 20 percent expected, but wide-open weather will accelerate this in the coming weeks. USDA’s grain stocks report this week didn’t help the bull camp.

The corn pile just seems to keep growing! With expectations for US corn stocks as of September 1st to increase to 1.337 billion bushels from last year’s 1.325 billion bushels, the USDA pegged corn stocks at a whopping 1.532 billion bushels! That is a huge number despite strong exports. Last year’s corn crop was also revised slightly higher from prior estimates. US soybean stocks were reduced to 316 million bushels versus expectations of 323 million bushels and last year’s 330 million bushels while last year’s soybean production increased slightly. Wheat stocks increased to 2.120 billion bushels from 2.043 billion bushels expected.

US wheat production estimates were also updated in this report release with all-wheat class production increased to 1.985 billion bushels from 1.925 billion bushels estimates and the prior estimate of 1.927 billion bushels. So, there was an increase instead of a decrease in US wheat production. Hard red winter wheat increased the most, but soft red winter wheat also increased. While wheat supplies have increased, it seems the market is tired of going lower.

The wheat market needs a trigger, but it also needs corn to rally. We’ve seen attempts at a rally this week led by soybeans and corn, but it’s failed to offer much strength. US wheat exports, like corn, have been strong, but with supplies adequate, there has been little to sustain a meaningful move.

Russia wheat export prices have been firming, and I could see some war premium returning to the wheat complex.

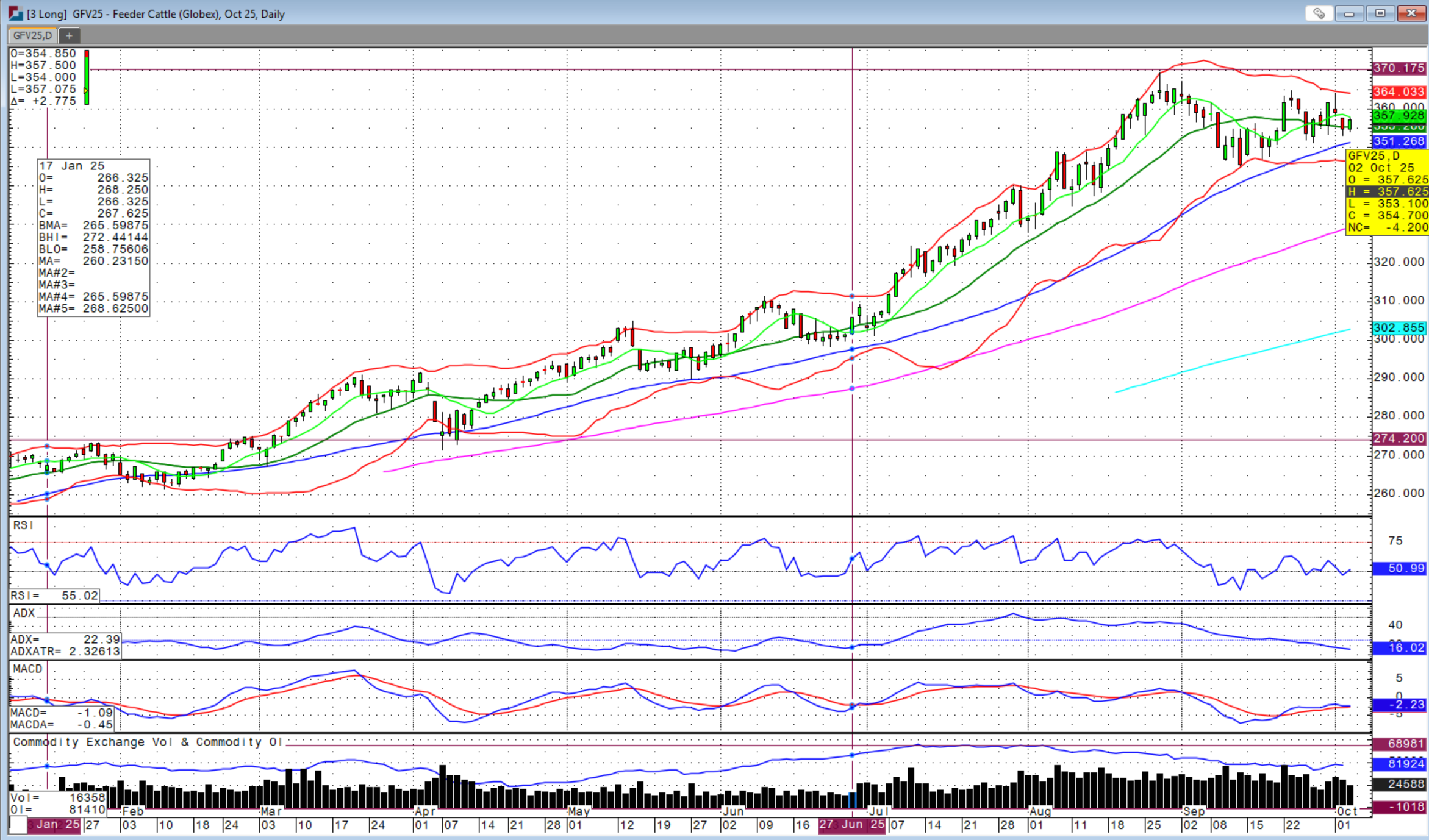

Over in the cattle complex, the situation is flip-flopped. There is plenty of demand, but limited supply that is only exacerbated by closed borders and tariffed imports. The market has continued to chop sideways since the late August highs resulting in lower highs, but so far higher lows, creating a wedge formation.

Friday’s inside day on feeder cattle charts with a strong close could see the chart gap above from Thursday’s lower open filled on Monday or Tuesday, but if we do not make a high above the October 1st high, we could see another selloff. With beef cutout prices easing and consumer sentiments waning, we could begin to see a softer demand profile in the coming weeks.

Fed cattle cash trade this week was light and topped out at $233 in Texas and Kansas. The FDA this week approved a short-term treatment for use against the New World Screw Worm that hasn’t captured much attention, but seems could gain some attention. This will only matter to the markets if and when it is able to expedite the reopening of the Mexican border. Keep an eye on this for developments as one would sure think pharma companies are doing so.

Sidwell Strategies is the one-stop shop to protect cattle with futures, puts, LRP or a combination of all, which is probably the best strategy overall. If you’re ready to trade commodity markets, give me a call at (580) 232-2272 or stop by my office to get your account set up and discuss risk management and marketing solutions to pursue your objectives. Self-trading accounts are also available. It is never too late to start and there is no operation too small to get a risk management and marketing plan in place.

Wishing everyone a successful trading week! Let us know if you'd like to join our daily market price and commentary text messages to stay informed!

Brady Sidwell is a Series 3 Licensed Commodity Futures Broker and Principal of Sidwell Strategies. He can be reached at (580) 232-2272 or at brady@sidwellstrategies.com. Futures and Options trading involves the risk of loss and may not be suitable for all investors. Review full disclaimer at https://www.sidwellstrategies.com/fccp-disclaimer-21951.