Billionaire Paul Singer Is Doubling Down on This Data Center Stock. Should You?

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

Equinix (EQIX) is back in the spotlight on news that Elliott Investment Management, an activist hedge fund led by billionaire Paul Singer, raised its stake to become one of its top-10 shareholders. This comes at a good time for the data center-focused real estate investment trust (REIT) as shares have fallen 15% this year so far as a result of margin compression and investor skepticism over its next phase of growth. Elliott’s recent move, with its track record of extracting shareholder value, is once again giving investors hope that change is on the horizon.

The data center industry remains strategically significant as demand for cloud compute and AI workload keeps rising sharply. Being a global leader in colocation with over 245 centers across 71 markets, Equinix remains well-positioned but must prove it is capable of delivering efficiency. After the company beat Q1 estimates and raised its 2025 guidance, investors are hopeful that a turnaround is underway.

About Equinix Stock

Equinix (EQIX) is data center REIT that supports cloud platforms, digital infrastructure operators, and enterprise clients. Equinix is located in Redwood City, California, with a $77.2 billion market cap, as well as over 245 IBX sites worldwide.

EQIX stock has been quite erratic, having fallen 15% for the year and trading nearly 20% below its 52-week high of $994.03. This uninspiring showing is a long way from a strong 8.5% rally for the S&P 500 Index ($SPX) in the same period.

One reason for the underperformance is that, at its June investor day, Equinix announced a heavy capex approach that scared investors. Nevertheless, the recent Elliott news has lifted shares about 2.7% over the previous five sessions.

From a valuation perspective, Equinix is trading at 23.7x forward earnings as well as 8.9x price-sales, premium valuations compared to other REITs. Plus, its P/E is moderately higher compared with its 5-year average, so its stock is moderately overpriced unless margin improvements materialize.

It pays a quarterly dividend and yields 2.3% currently, offering steady income as well as long-term potential for capital appreciation.

Equinix Beats on Earnings

Equinix posted strong Q1 2025 numbers, delivering revenue of $2.2 billion, up 5% year over year. Operating income surged 26% to $458 million, with net income rising 48% to $343 million, or $3.50 per share. That was better than Wall Street forecasts and revealed strong underlying demand.

Management raised full-year revenue guidance to $9.175 billion to $9.275 billion and boosted its adjusted EBITDA forecast to $4.471 billion to $4.551 billion, implying a 210-basis point margin expansion to 49%. Adjusted funds from operations (AFFO) guidance was also lifted to a range of $3.675 billion to $3.755 billion, or $37.36–$38.17 per share, representing 7%-9% growth.

In addition to the numbers, Equinix revealed strong traction in its AI-ready data centers. It became the first to host Nvidia’s (NVDA) Blackwell-powered DGX SuperPOD systems, thus making it a key enabler of next-gen AI training as well as inference workloads. Block (XYZ) and Groq are both very early adopters, a testament to Equinix’s success with blue-chip customers.

The company has 56 projects under construction in 24 countries and is constantly expanding its xScale portfolio, of which more than 85% of its capacity is leased or pre-leased.

What Do Analysts Expect for Equinix Stock?

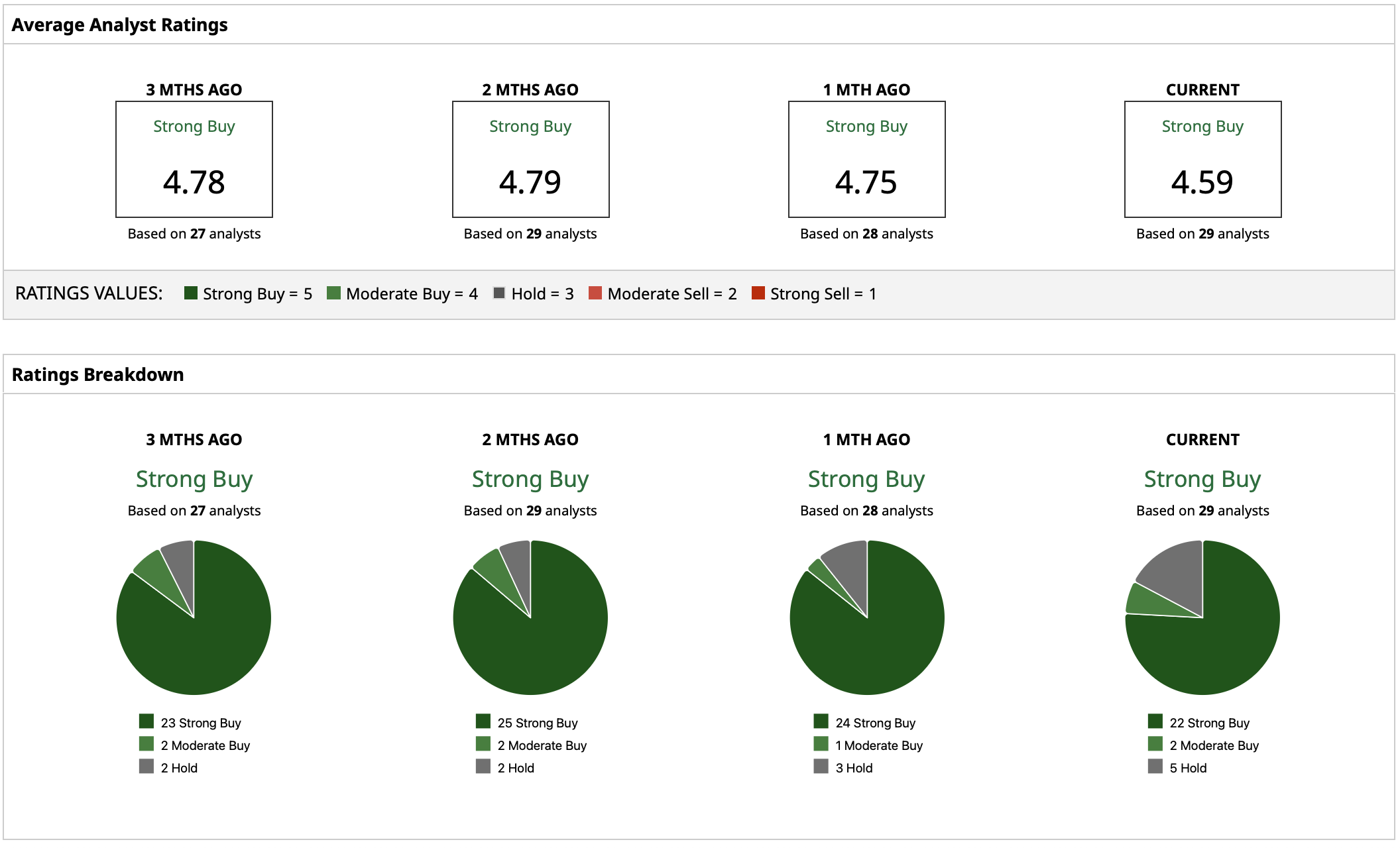

Equinix has a “Strong Buy” consensus rating from the 29 analysts in coverage. 22 of them rate it as a “Strong Buy,” two as a “Moderate Buy,” and five as a “Hold.”

Plus, the renewed activity from Elliott could trigger a wave of upward revisions. Its average target price stands at $950.77, reflecting a 19% possible rise from its current price. Its high target of $1,200 implies a 50% increase.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.