Is SentinelOne Stock a Buy, Sell, or Hold in July 2025?

/Cybersecurity%20by%20AIBooth%20via%20Shutterstock.jpg)

A fresh cyberattack targeting Microsoft’s (MSFT) widely used SharePoint server software sent shockwaves through the cybersecurity industry this week. As reports of the exploit surfaced, investors rushed into names they believe are best positioned to combat these evolving threats.

SentinelOne (S) was among the biggest winners, surging 8% in midday trading on July 21. The company’s advanced Singularity Platform, powered by AI and built to secure endpoints, cloud workloads, and identity systems, has drawn renewed investor confidence. Peers like CrowdStrike (CRWD), Palo Alto Networks (PANW), and Fortinet (FTNT) also saw strong upside.

But among them, SentinelOne’s aggressive innovation and autonomous threat response tech have set it apart. So, as cyber risks mount and investor interest heats up, the question now is: Is SentinelOne stock a buy, sell, or hold? Let’s dig in.

About SentinelOne Stock

Based in California, SentinelOne is a leading cybersecurity firm known for its AI-powered Singularity Platform.

The Singularity Platform provides autonomous threat prevention and response capabilities. Its platform is designed to offer comprehensive visibility and protection across endpoints, cloud workloads, and identity credentials. SentinelOne’s focus on an AI-driven approach, combined with its ability to provide a unified cybersecurity solution, sets it apart from many competitors who may rely on more traditional, manual threat management techniques.

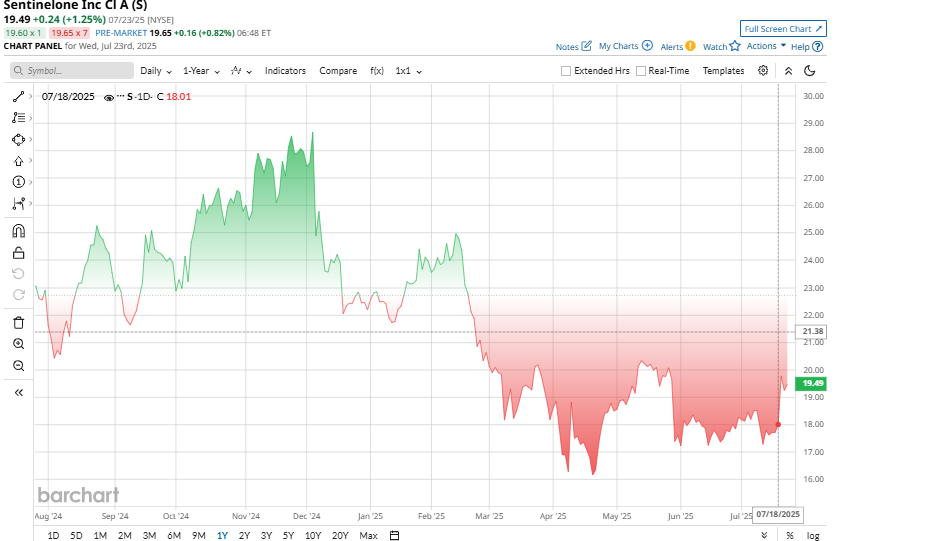

Valued at $6.5 billion by market cap, SentinelOne shares have had a tough 2025. After hitting a 52-week high of $29.29 in November 2024, the stock has dropped about 11% year-to-date, pressured by a lowered full-year revenue outlook and mounting competition in the crowded cybersecurity landscape.

In terms of valuation, SentinelOne trades at 7.9x forward sales, well below peers like CrowdStrike at 29x and Palo Alto Networks at 16.6x. Given its strong growth and AI-driven edge, this discounted valuation supports bullish sentiment and reflects its unique niche in autonomous cybersecurity.

SentinelOne Q1 Revenue Surges, Yet the Company Lowers Outlook

On May 28, SentinelOne posted its first quarter results for fiscal year 2026, which showed robust growth with mixed profitability. Total revenue was came in $229.0 million, up 23% year-over-year, while annual recurring revenue (ARR) hit $948.1 million 24% growth YOY.

About two‑thirds of that revenue comes from the U.S., with the rest spread across international markets. Their gross margins are solid, too, around 75% on a GAAP basis and 79% when you strip out certain non‑cash costs.

On the earnings front, though, GAAP accounting still shows a $208 million loss, about 91% of revenue, which is wider than the $70 million loss reported a year ago. However, when you back out non‑cash expenses like stock‑based comp and amortization, SentinelOne actually squeezed out a small profit, about a 3% net margin. That translated to roughly $0.02 of adjusted EPS, in line with expectations.

SentinelOne produced record cash flow in this quarter, generating cash flow at a 20% this quarter versus 18% last year and ended Q1 with roughly $1.2 billion in cash and investments on hand.

However, headwinds remain. Management noted elongated sales cycles and macro uncertainty impacting net new ARR growth. Competition in cybersecurity is fierce, and SentinelOne must execute on cross-selling and efficiency. The recent guidance cut hints at caution.

SentinelOne cut its full-year revenue guidance between $996 million and $1 billion, down from $1.01 billion to $1.012 billion, blaming softer enterprise spending, economic uncertainty and intensifying endpoint security competition.

Conclusion: Buy, Sell, or Hold?

SentinelOne looks like a classic growth stock that’s starting to turn the corner toward profitability. Revenue is growing steadily, about 23% to 29% a year, and free cash flow has finally flipped into positive territory.

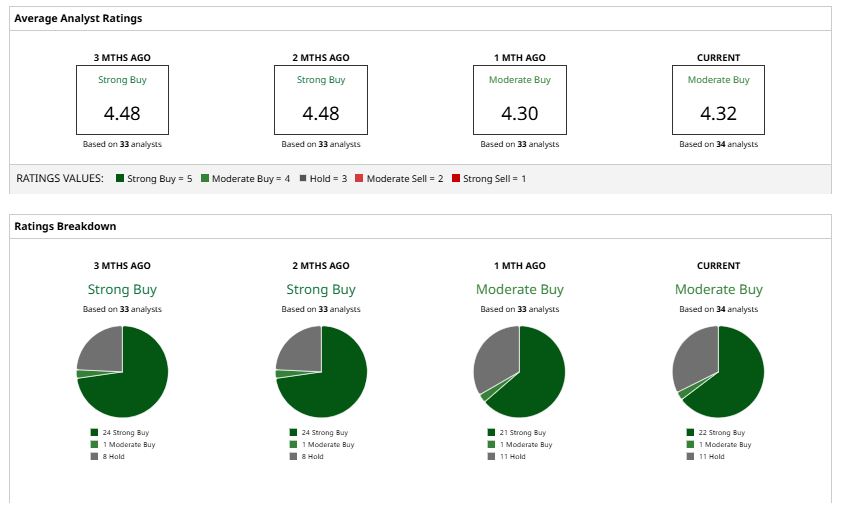

Wall Street seems cautiously optimistic. Analysts have a “Moderate Buy” rating overall, with 22 calling it a “Strong Buy,” one more tagging it a “Moderate Buy,” and 11 sitting on the sidelines with a “Hold.” The average price target is $23, which suggests about 16% upside from here.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.