Why GOOGL Stock May Be the Market’s Next Big Winner

/Alphabet%20Inc_%20and%20Google%20logos%20by%20IgorGolovinov%20via%20Shutterstock.jpg)

Alphabet (GOOGL), Google’s parent company, recently reported one of its most impressive quarterly results to date. From soaring Search and YouTube revenues to explosive growth in Cloud and creative advertising tools, Alphabet is using artificial intelligence (AI) not only to innovate, but also to monetize.

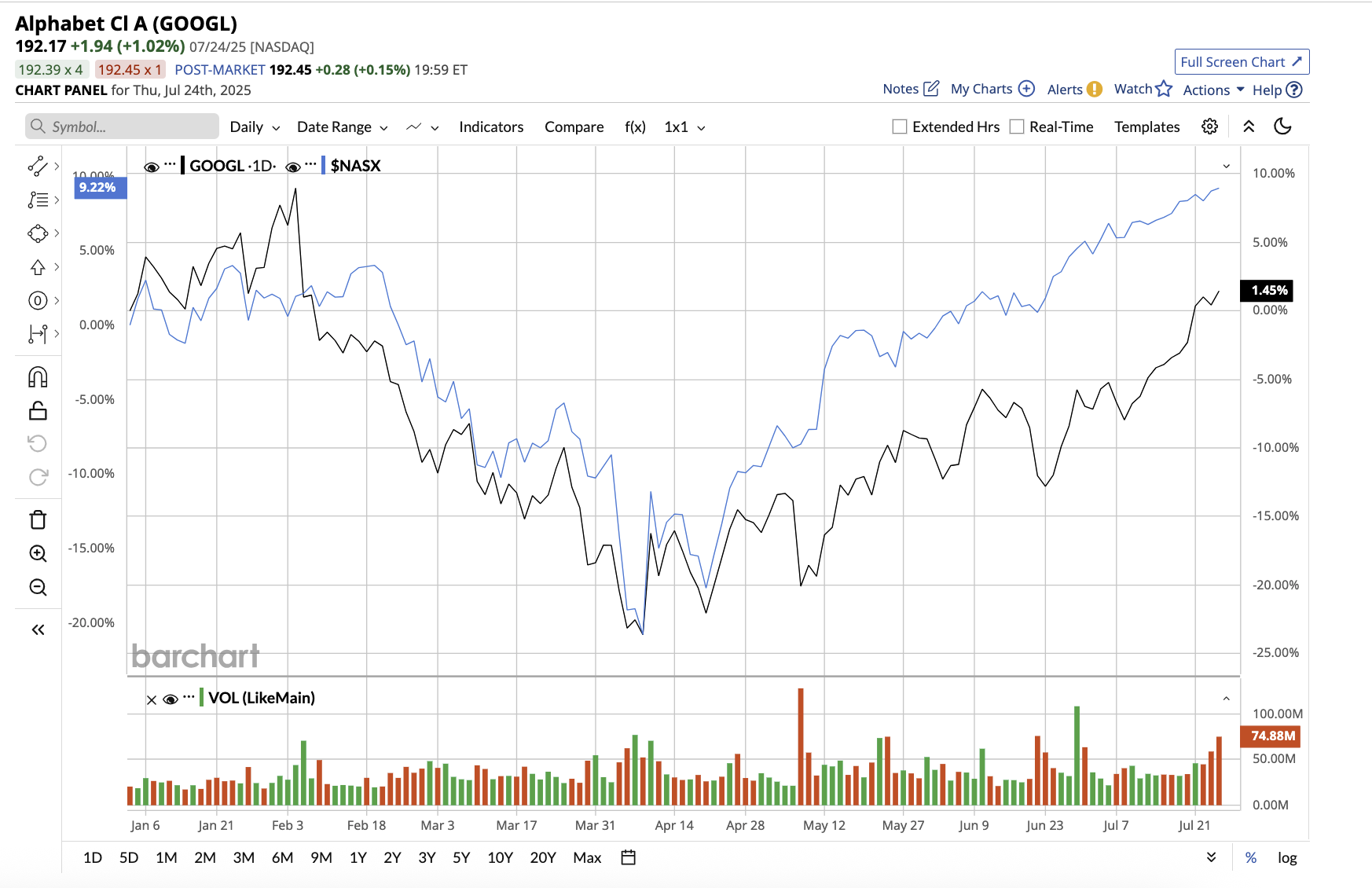

Valued at $2.3 trillion, GOOGL stock has gained 1.8% year-to-date, but there is long-term upside in the coming years. With momentum building across all core segments (Search, YouTube, Google Cloud, and Ads), GOOGL stock could be the next big winner in the market’s AI race.

AI Is Alphabet’s Superpower

AI is driving meaningful engagement across the company’s ecosystem. In the second quarter, total revenue reached $96.4 billion, up 14% year-over-year. Google Services contributed $83 billion, with Search and other revenues rising 12% to $54.2 billion, driven by retail and financial services. Net income climbed 19% to $28.2 billion, and EPS increased 22% to $2.31.

Search, Google’s flagship product and the company’s largest moneymaker, is undergoing a significant transformation thanks to AI. During the earnings call, CEO Sundar Pichai stated that AI has evolved from a feature enhancement to a structural growth driver. Management specified that Gemini 2.5 now supports more than 2 billion monthly users in 200 countries and 40 languages. These AI developments have not only improved search quality, but also increased user engagement by increasing the number of follow-up queries, particularly among younger users. The introduction of AI Mode in Search marked a significant improvement, with over 100 million monthly active users in just two markets for now, the U.S. and India.

Google Cloud remained a pillar of Alphabet’s AI strategy, with an annual revenue run rate of $50 billion. It also holds a third position in the global computing market, trailing Amazon’s (AMZN) AWS and Microsoft’s (MSFT) Azure. In the second quarter, Google Cloud generated $13.6 billion in revenue (+32% YoY) and nearly doubled its operating margin from 11.3% to 20.7%. The cloud backlog (revenue yet to be recognized) increased to $106 billion, up 38% YoY, indicating sustained demand. The company reported increased profitability and record deal activity, with the number of contracts exceeding $250 million doubling YoY.

While AI and Cloud dominated the headlines, YouTube remained Alphabet’s reliable growth engine. According to Nielsen data, the platform continues to lead in U.S. streaming watch time, with more than 200 billion daily views on Shorts. YouTube advertising revenue increased 13% YoY to $9.8 billion, driven by direct response and brand campaigns.

YouTube Shorts continues to grow, surpassing 200 billion daily views. AI-powered tools, such as enhanced recommendations and auto-dubbing, are allowing creators to broaden their audience. In short, AI is transforming Shorts from a TikTok competitor to a profitable advertising platform. Alphabet is increasingly generating recurring revenue from subscriptions. The expansion of Google AI Pro and Ultra plans contributed to strong subscription momentum this quarter. Subscription revenue rose 20% to $11.2 billion.

A Market Leader in the Making

To support this AI-driven growth, Alphabet is making significant infrastructure investments. CapEx totaled $22.4 billion, with two-thirds going to servers and the rest going to data centers and networking equipment. Alphabet increased its CapEx guidance for 2025 to $85 billion, up from $75 billion, in order to meet cloud demand and accelerate the deployment of AI infrastructure. More investment is expected by 2026.

As management implied, this spending contributes to a near-term increase in depreciation expenses. However, Google is creating a moat in AI compute and cloud infrastructure, positioning itself as a long-term leader in AI services. While often overlooked in favor of Alphabet’s core segments, Waymo is quietly expanding by launching service in Atlanta, doubling its footprint in Austin, and increasing coverage in Los Angeles and the San Francisco Bay Area by half. While Waymo does not currently generate much revenue, it is expected to be a growth catalyst in the future.

Alphabet ended the quarter with an enormous reserve of cash of $95 billion. Free cash flow for the second quarter stood at $5.3 billion, with a trailing 12-month total of $66.7 billion. The company distributed $2.5 billion in dividends and $13.6 billion in share repurchases.

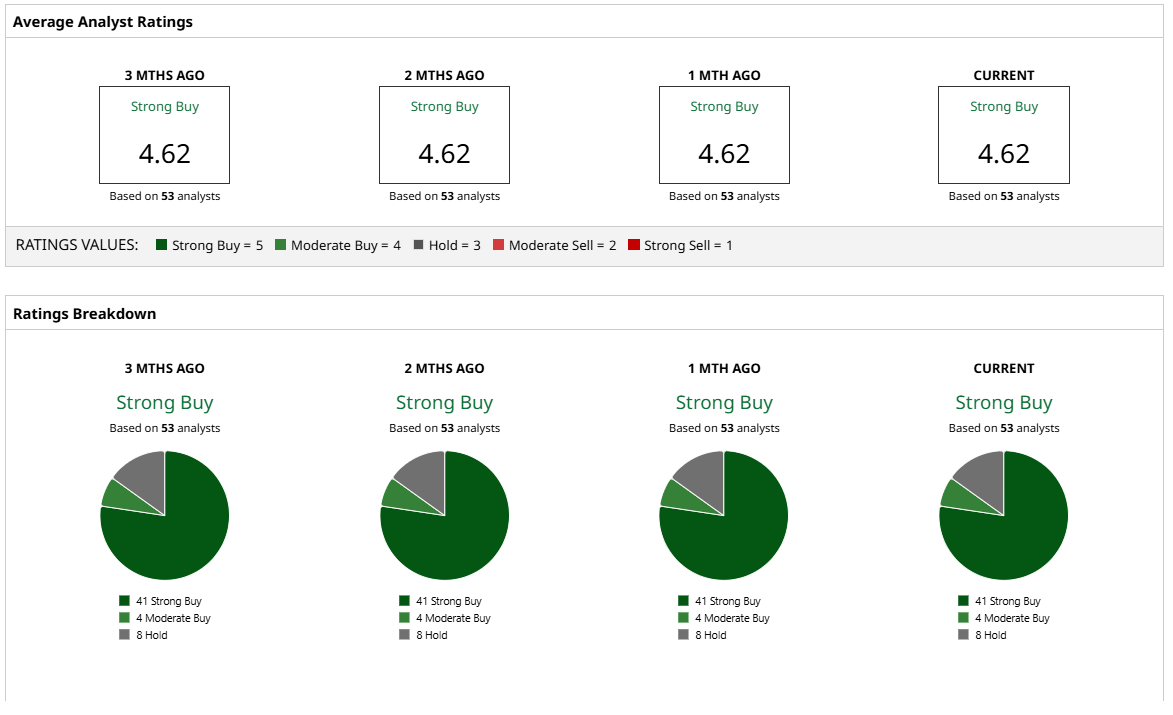

Is GOOGL Stock a Buy, Hold, or Sell on Wall Street?

Overall, on Wall Street, GOOGL stock is a “Strong Buy.” Of the 53 analysts covering the stock, 41 rate it a “Strong Buy,” four say it is a “Moderate Buy,” and eight rate it a “Hold.” The average target price of $206.86 implies the stock can rise by 7% from current levels. Plus, its high price estimate of $250 suggests the stock has an upside potential of 30% over the next 12 months.

Despite rising R&D and legal costs, Alphabet remains profitable while investing heavily in the future. That balance (growth and discipline) is uncommon, particularly among Big Tech rivals striving for AI dominance. Alphabet’s long-term AI bets will continue to yield results. At an attractive valuation of 19 times forward earnings and 5 times forward sales, GOOGL stock remains a great long-term buy-and-hold play.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.