3 Top Cybersecurity Stocks to Buy Now

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

Some administrators who logged in last week found their on-premises Microsoft SharePoint servers silently uploading web shells instead of documents. A single, carefully forged packet had slipped past every guardrail and granted attackers full remote control before any human had typed a password.

What unfolded is now known as the ToolShell exploit chain. Security researchers at the Dutch firm Eye Security noticed an unusual file on a client’s server and sounded the alarm.

Thousands of organizations worldwide use SharePoint.

Does this prove that hackers are becoming better and more dangerous? The uncomfortable answer is yes. As the internet becomes the primary place where corporations store their valuable data, cybersecurity is only going to get more important.

Here are three cybersecurity stocks that have seen positive price action since the exploit. They have also topped Barchart’s cybersecurity stocks list, sorted by analyst recommendations.

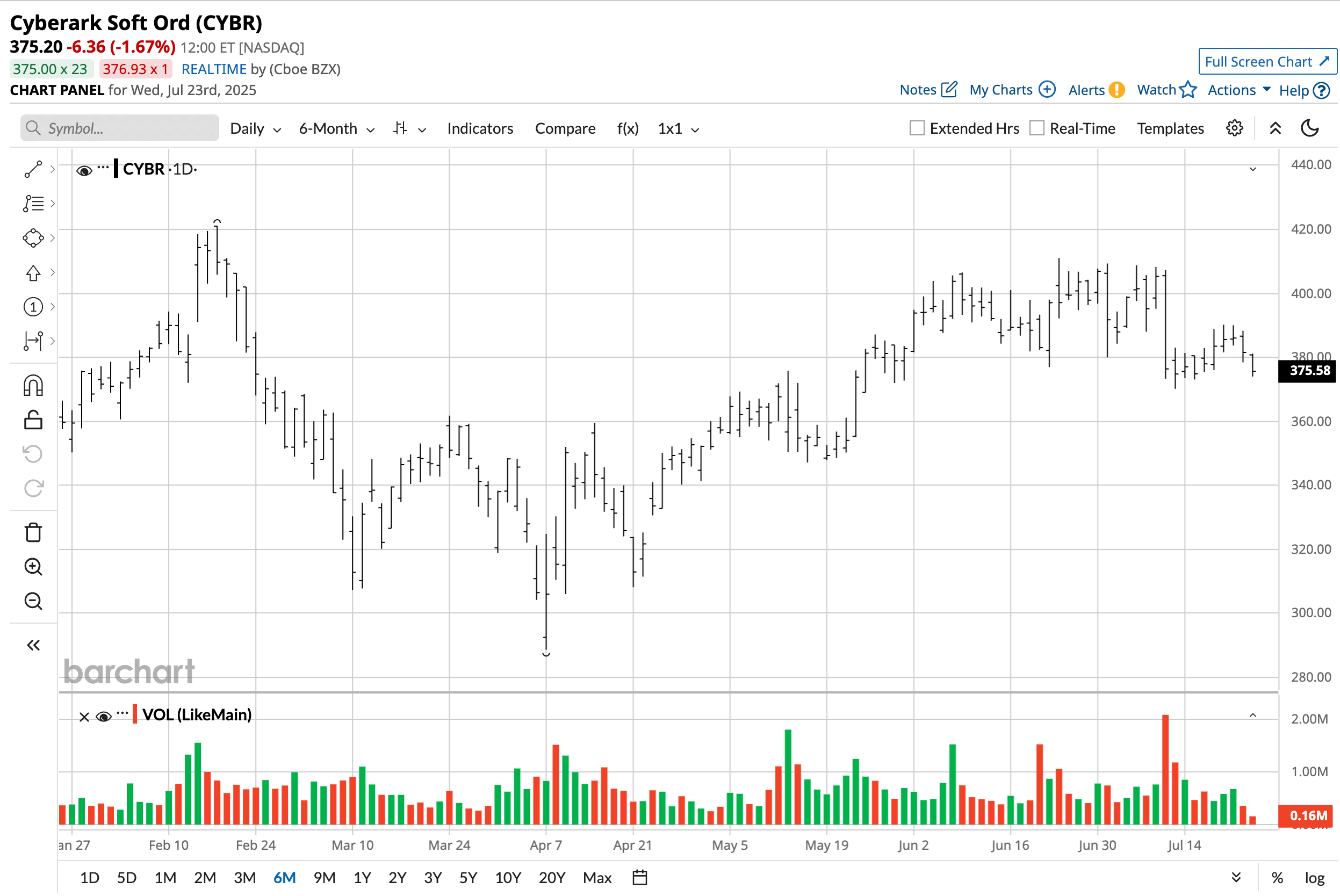

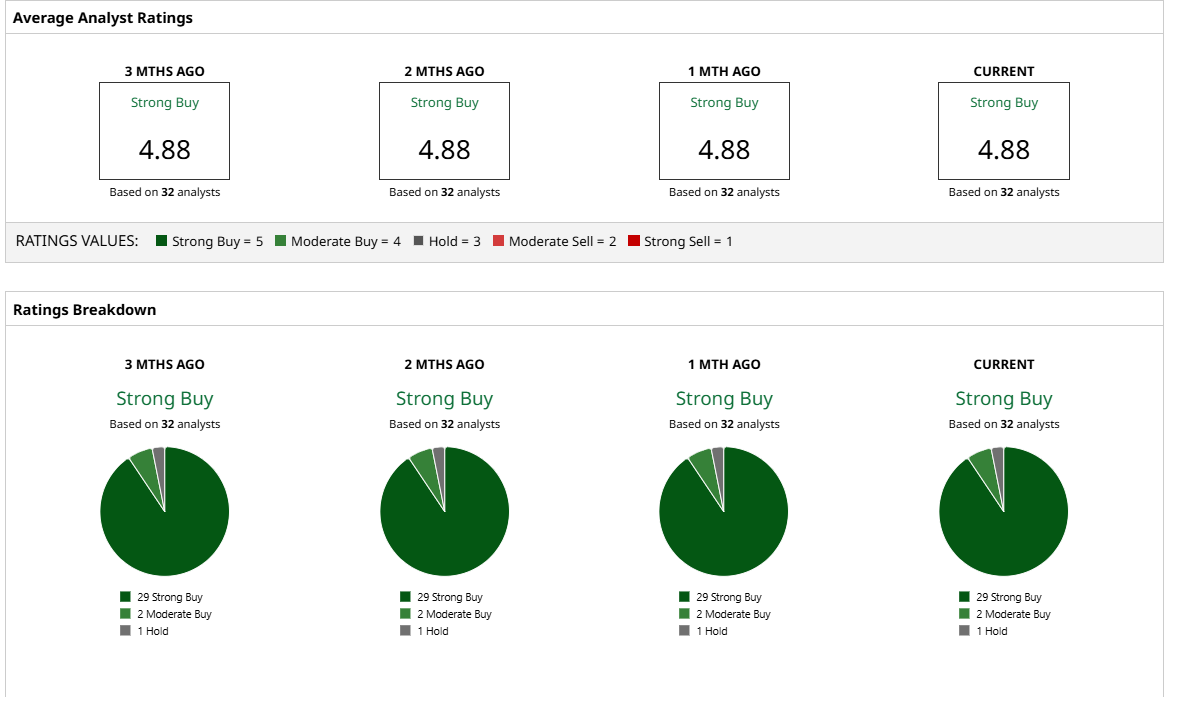

Cybersecurity Stock #1: Cyberark Software (CYBR)

CyberArk Software (CYBR) is not as familiar as a name as CrowdStrike (CRWD) or Palo Alto (PANW), but the Israeli company has built its reputation on privileged access management. More than half of Fortune 500 companies and roughly 35% of the Global 2000 rely on CyberArk to lock down the credentials that attackers prize most.

Its solutions portfolio stretches from the classic Privileged Access Manager to newer software-as-a-service offerings such as Privilege Cloud, Endpoint Privilege Manager, and Secure Cloud Access, all unified under an identity security platform that now includes machine identities and, most recently, artificial intelligence agents.

Q1 revenue increased 43% to $318 million. Subscription sales grew 60% year-over-year, and annual recurring revenue crossed the $1 billion mark for the first time at $1.215 billion. 85% of that total now comes from subscriptions rather than older perpetual licenses.

Management guided full-year revenue to roughly $1.3 billion, implying 31.5% growth without assuming any additional large deals.

The mean price target here is $449, with targets going up to $500.

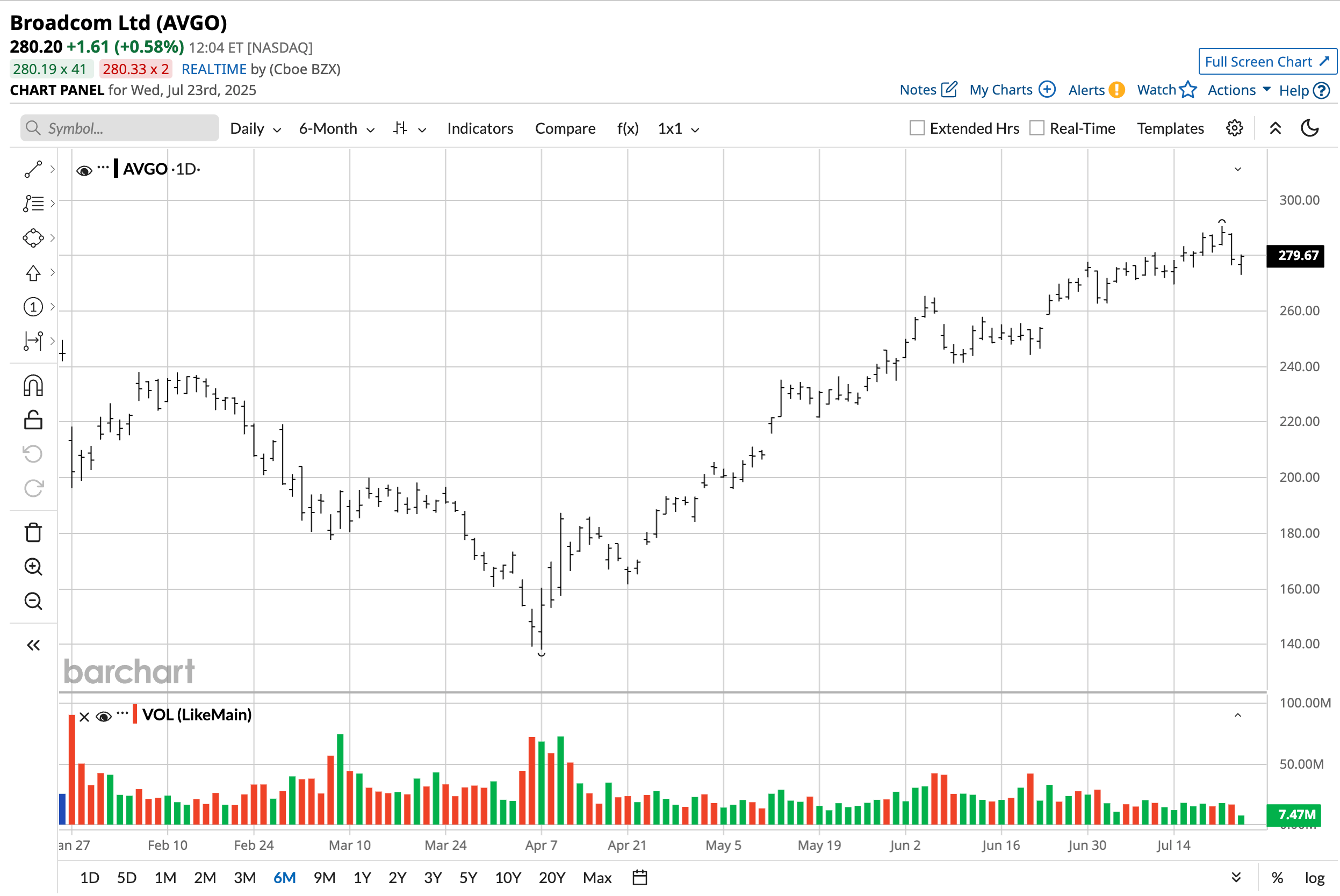

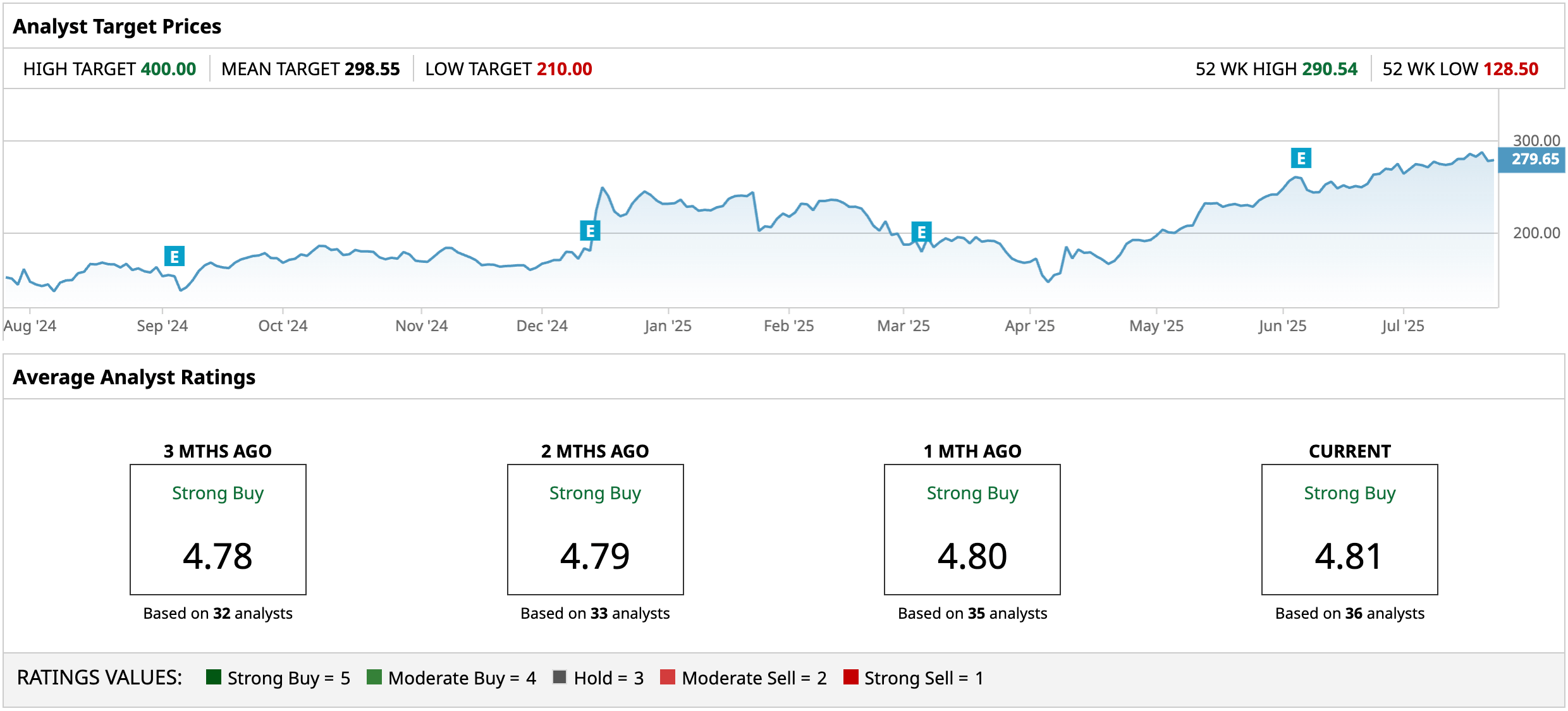

Cybersecurity Stock #2: Broadcom (AVGO)

Broadcom (AVGO) is as much a cybersecurity company as it is a chip designer. It acquired the Symantec division in 2019, and its Endpoint Security Complete is now the default choice for enterprises that run virtual machines like VMware.

Broadcom’s infrastructure software grew 47% year-over-year to $6.7 billion in Q1. In Q2, it grew 25% year-over-year.

Looking ahead, the company guided to $15.8 billion of revenue for Q3, up 21% year-over-year, and reiterated that AI-driven security will be one of the two main growth vectors alongside custom AI accelerators. Free cash flow is already running at more than $6.4 billion per quarter, and management returned $7 billion to shareholders through buybacks and dividends last quarter alone.

Out of 36 analysts, 32 tag it as a “Strong Buy,” with one “Moderate Buy” and three “Hold” ratings.

Price targets go up to $400, with the mean price target at $298.55.

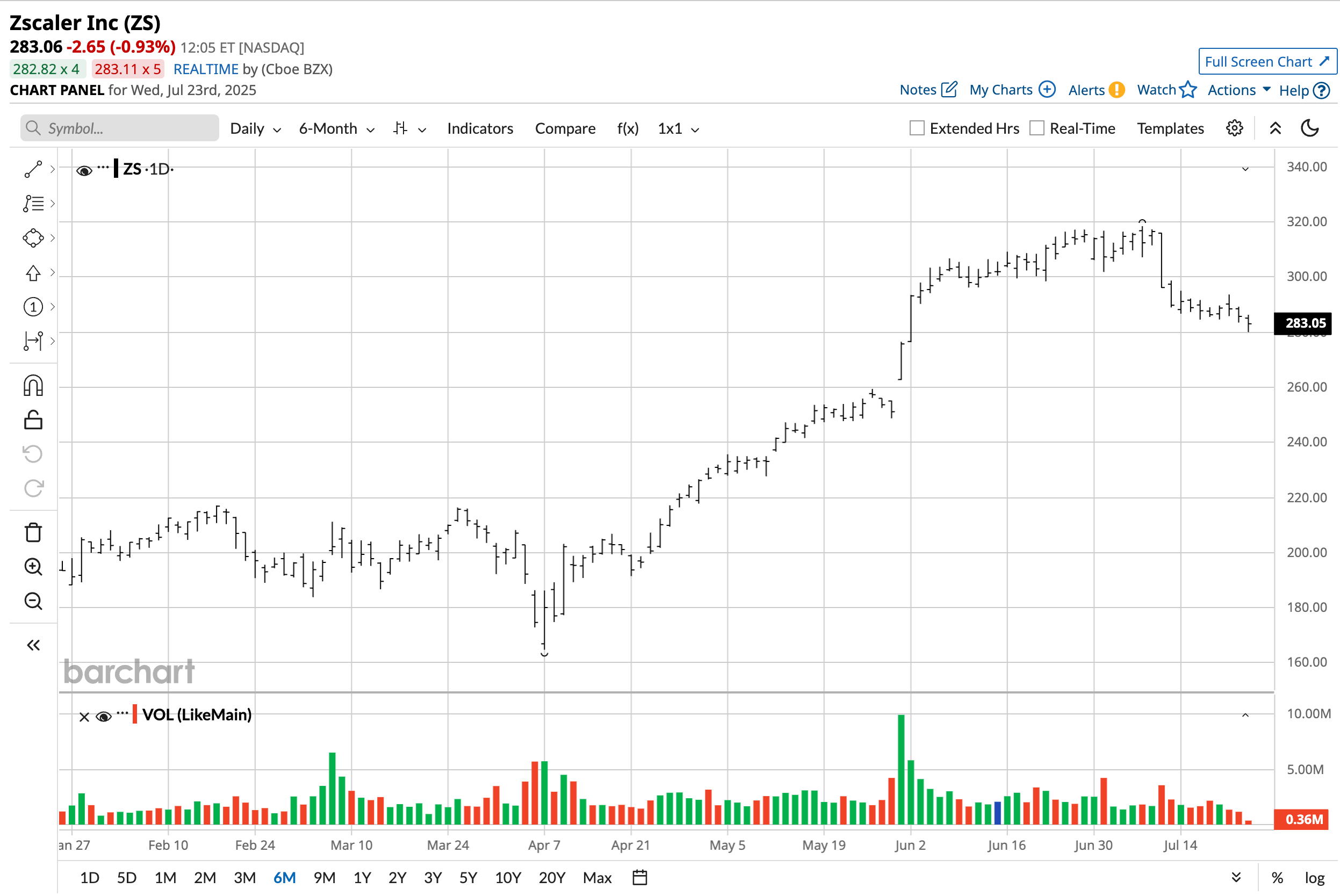

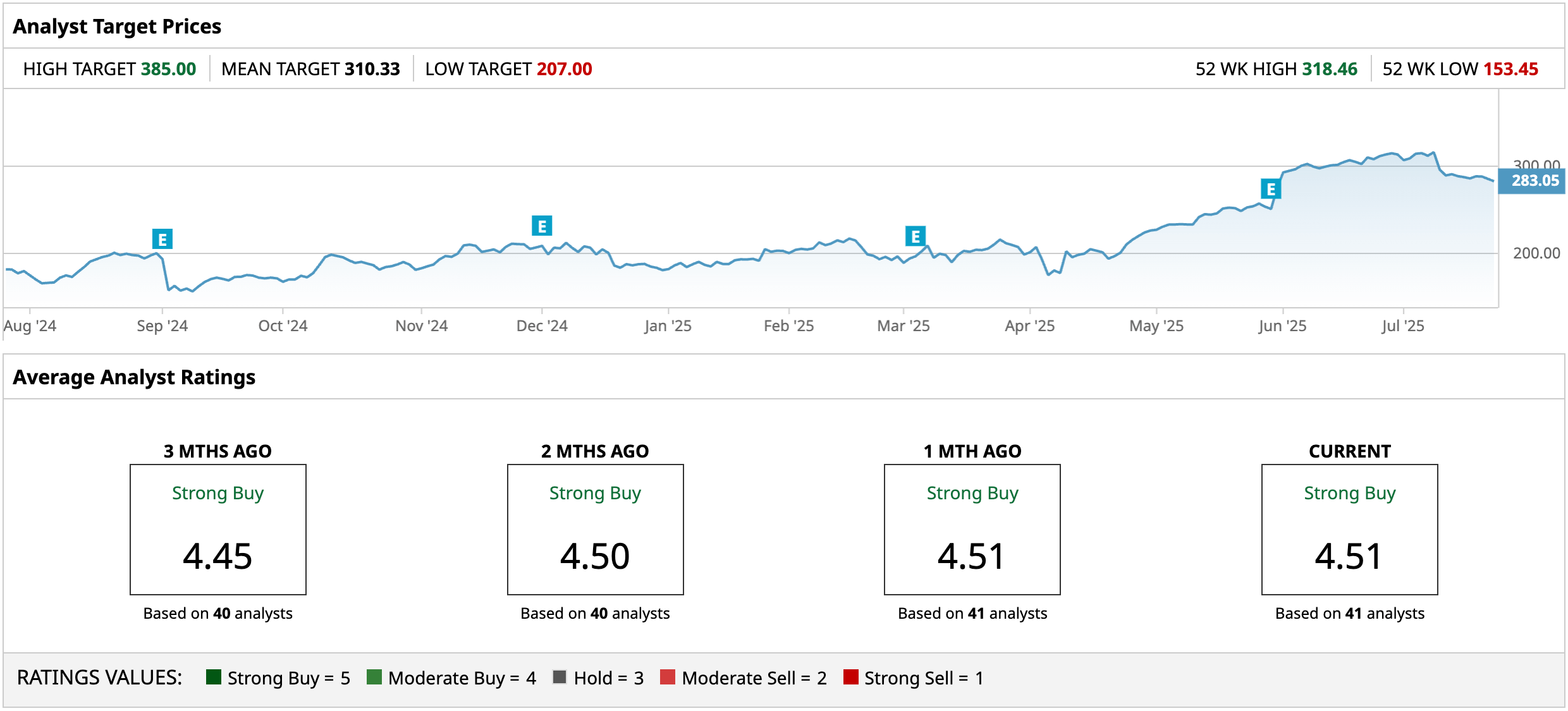

Cybersecurity Stock #3: Zscaler (ZS)

Zscaler (ZS) is a cloud-based cybersecurity company. It sends all traffic through a single cloud checkpoint before anything touches the open web or a private server. It is becoming more popular as many see it as a better solution due to its Zero Trust mode, which does not give any device trusted access. Hence, hackers can’t take over the network if any device is hacked.

Fiscal Q3 results exceeded even the most optimistic projections. Revenue rose 23% year over year to $678 million. Calculated billings, a forward-looking gauge of contract signings, jumped 25% to $785 million, while deferred revenue climbed 26% to just under $2 billion.

Earnings per share came in at 84 cents, 12% ahead of expectations and nearly 20% higher than the year-ago quarter. The balance sheet is equally sturdy. Zscaler now holds more than $3 billion in cash and short-term investments.

There are price targets going to $385, with the mean price target at $310.33.

On the date of publication, Omor Ibne Ehsan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.